SOG (Singapore Obstetrics and Gynaecology) is one of the cheapest healthcare companies listed on the Singapore stock exchange.

Healthy growth across all economic conditions is a key strength for this female healthcare company with its focus on resilient specialist practices such as obstetrics, Gynae-oncology, and paediatrics.

SOG was incorporated in 2011, listed on the SGX in 2015, and as of end- 2017, SOG employs 12 specialist doctors which includes six O&G specialists, three cancer specialists, one dermatologist and two paediatricians.

Steady earnings across all economic conditions

| SOG results (SGD m) | |||||||

| Year | Revenue | Net profit | Operating cash flow | Free cash flow | Net profit margin | ROE | Net cash |

| 2012 |

8.1 |

3.0 | 2.1 | 1.9 | 37% | 62.3% | 4.6 |

| 2013 | 8.6 | 3.1 | 3.4 | 3.2 | 36% | 46.6% | 6.4 |

| 2014 | 13.5 | 4.2 | 5 | 7.1 | 31% | 45.6% | 11.3 |

| 2015 | 16.4 | 5.3 | 6 | 6.1 | 33% | 29.7% | 24.2 |

| 2016 | 28.7 | 8.8 | 10 | 3.6 | 31% | 26.8% | 21.3 |

| 2017 | 29.9 | 8.5 | 2 | 1.6 | 28% | 19.9% |

16.4 |

SOG has grown its net profit at 19% CAGR from 2014 to 2017 with a clean balance sheet and high ROE. Revenue has more than doubled from 2014 to SGD29.9 million in 2017 while net profit has doubled to SGD8.5 million during the same period.

2017 was a tough year for SOG but I’ll explain later why things are improving in 2018. Net profit fell 3% year on year to SGD8.5 million in 2017 because of fewer baby deliveries, dermatology patients and start-up costs related to its paediatric segment.

SOG doctors delivered 1,716 babies in 2017, a 1% year on year decline due to the Zika virus outbreak. Despite these challenges, SOG was able to grow its 2017 market share of the private birth market to 8%, up 0.5% compared to 2016.

SOG earnings are recovering nicely as of the first quarter of 2018 with all of its segments growing year on year. Q1 2018 revenue was up 17% year on year while net profit grew 23% year on year to SGD2.5 million. Growth in the O&G and dermatology segment which are its two largest segments suggests that SOG is positioned for a better 2018. Latly, the paediatric segment is expected to break-even in 2018.

Caring for women and children’s health

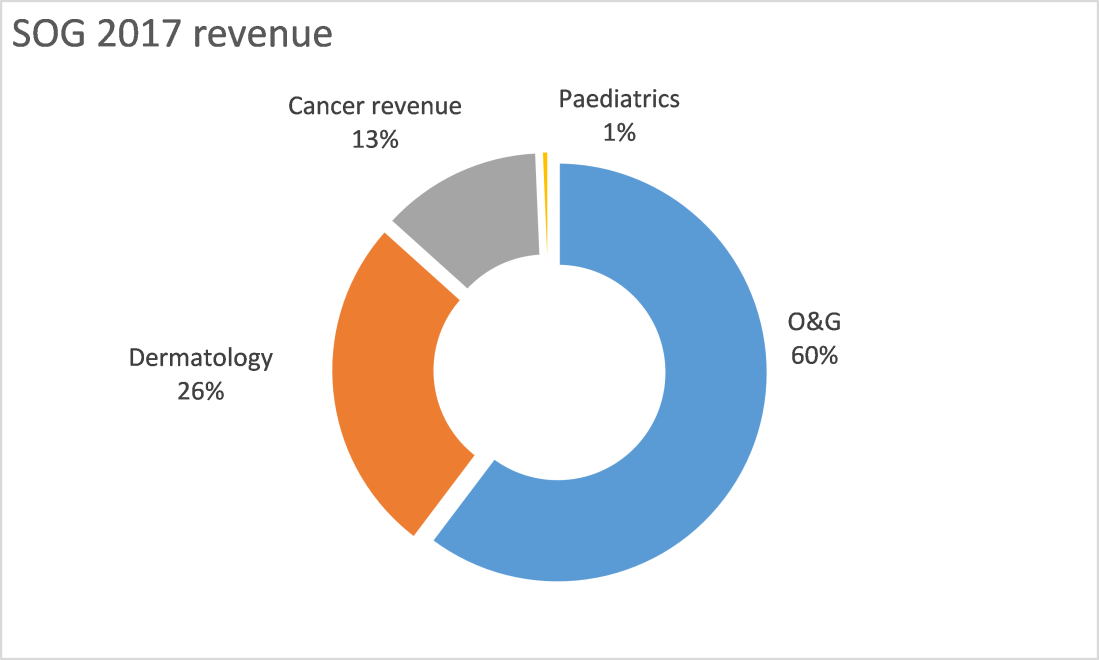

SOG has four business segments: Obstetrics, Dermatology, Gynea-oncology and paediatrics. While the O&G segment is currently the largest revenue contributor (~60% of total revenue in 2017), SOG’s long term goal is for equal revenue contributions across all four segments.

Expanding into the paediatrics, dermatology and gynea-oncology segments allow SOG to provide continued patient care and support for its patients as they age.

Paediatrics is a resilient specialty and allows SOG to accompany patients from birth.

SOG delivered more than 1,700 babies in 2017 so expanding into paediatrics is a natural fit. Paediatrics allows SOG to stay connected to younger patients, particularly female patients. Like obstetrics, this business is less vulnerable to low cost foreign competition.

SOG’s first paediatric clinic (Dr Lim Xue Yan) began operations in 3Q 2017 and is in the same hospital as two of its key O&G doctors: Dr Heng Tung Lan and Dr Natalie Chua. Dr Heng and Dr Natalie Chua deliver a combined total of almost 1,000 babies annually which will be a strong referral pipeline for the new clinic.

The company’s second paediatric clinic was established in November 2017 and is located in Tiong Bahru. Management targeting for this segment to contribute a small profit by end-2018.

Dermatology has clear synergies with O&G

SOG established its dermatology business by acquiring Dr Joyce Lim’s dermatology practice in end-2015 for SGD26.5m (11x P/E). Dr Joyce has signed a 8 year service agreement with non-compete clauses. This deal has been the first and only M&A deal done by SOG. SOG patients who have skin problems due to pregnancy or going through hormonal changes can now consult Dr. Joyce. However, dermatology is vulnerable to overseas competition. In 2017, SOG’s dermatology revenue fell 7% year on year due to medical tourism weakness.

SOG is exploring the development of a stretch mark or pigmentation cream together with Dr Joyce Lim which can be offered to SOG patients. Dr Joyce’s proprietary skin care products can also be marketed through SOG clinics. SOG intends to recruit junior aesthetic doctors who will be trained by Dr. Joyce.

Cancer segment growing since 2015 and is now the third largest segment

SOG is focused on female-related cancer cases such as breast cancer and this segment is well positioned to deal with the growing number of cancer cases in Singapore and Singapore’s ageing population. By 2030, the number of Singaporeans aged 65 and above is projected to double to 900,000 according to the Department of Statistics. That means 1 in 4 Singaporeans will be in that age group, up from 1 in 8 today.

Cancer is the #1 cause of death in Singapore according to Singapore’s Ministry of Health while breast cancer is the most common form of cancer among in Singapore.

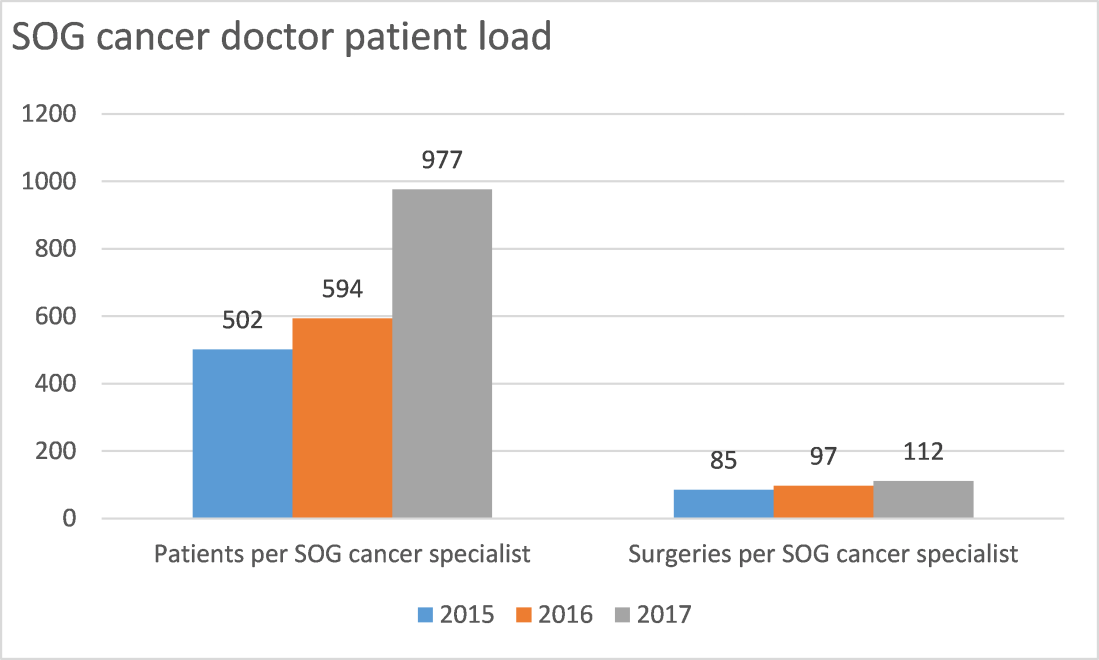

SOG established its cancer segment in 2015 by recruiting two cancer specialists. The Cancer segment was profitable within 12 months and currently contributes 10% to total operating profit in 2017. This segment is growing quickly in terms of patient and surgery load.

SOG cancer specialists work in the same clinic as O&G doctors and benefits from their patient referrals. Operating profit from the segment more than doubled to SGD0.9 million in 2017.

Management is aligned with shareholders

SOG was founded by Dr Heng Tung Lan and Dr Lee Keen Whye, two gynaecologists who have more than 30 years of medical experience each. Dr Heng is a key contributor to the company’s profits with Dr Heng generating ~SGD2 million in net profit per year or 25% of SOG’s 2017 net profit.

Based on the 2017 annual report, Dr Heng and Dr Lee collectively own 47% of SOG shares and are the largest shareholders in the company. Their combined shares are worth SGD80 million so they clearly have skin in the game.

Valuation

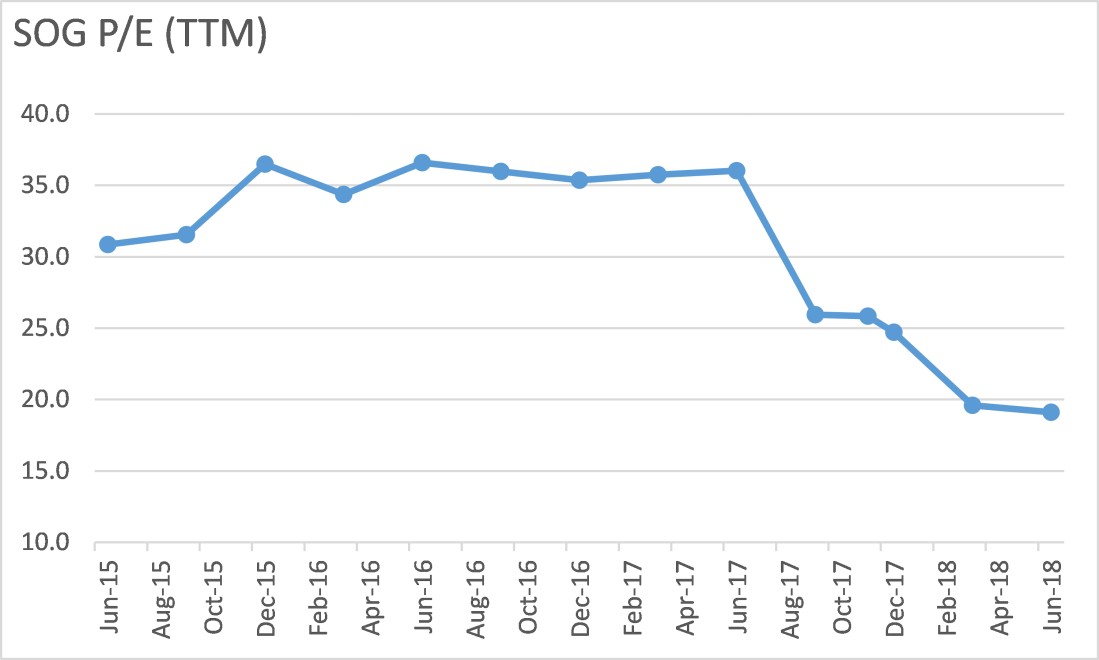

SOG’s share price has fallen by 47% over the last 12 months because of the lack of earnings growth and concerns over the abrupt resignation of its previous CEO, Dr Victor Ng in January 2018. SOG has assured the market that the reasons for Dr Ng’s departure was personal in nature and “no associations and causes should be inferred”. SOG reported strong revenue and earnings growth in the first quarter of 2018 so the company’s explanation for Dr Ng’s departure seems reasonable.

With a trailing P/E of 19x, SOG’s valuation is at the lower end of its trading range since its June 2015 IPO. This seems to be a fair price given its recurring earnings and robust growth potential.

Insiders have also been buying which suggests that the current valuation is cheap. In February 2018, Dr Joyce bought 100,000 shares at SGD0.39 per share. Meanwhile, Dr Heng and Dr Lee, the two co-founders of the company bought 100,000 shares each at SGD0.47 per share in 2017.

| SOG peers | ||||||

| Share price | P/E (TTM) | EV/EBITDA | Dividend yield | 2017 ROE | Net debt to EBITDA | |

| SOG | 0.36 | 19.1 | 13.6 | 4.2% | 19.9% | Net Cash |

| ISEC | 0.30 | 18.6 | 11.1 | 4.0% | 11.5% | Net Cash |

| Talkmed | 0.67 | 30.3 | 22.4 | 3.3% | 45.6% | Net Cash |

| Raffles Medical | 1.06 | 26.5 | 20.0 | 1.9% | 9.6% | Net Cash |

| Q&M | 0.53 | 17.2 | 31.4 | 2.1% | 20.1% | 3.2 |

SOG is also cheap compared to its peers. The company has a lower P/E compared to almost all of its peers despite its decent ROE and 100% focus on Singapore.

There is decent upside based on its growth potential. Here are my valuation assumptions:

- In 2017, O&G contributed ~SGD6.2 million in net profit, Dermatology contributed ~SGD1.7 million and Cancer contributed ~SGD0.6 million net profit.

- Let’s assume O&G net profit stays flat at around SGD6 million in 2022

- Dermatology, Paediatrics and Cancer each contributes SGD3m of net profit in 2022.

- This works out to a total net profit of SGD15 million in 2022.

- Applying a 20x trailing earnings multiple (similar to its existing valuation) to its 2022 net profit would imply a market cap of SGD300 million! (~75% upside)

I believe my assumptions are achievable for several reasons.

Firstly, O&G market share in Singapore as of 2017 is only 8% so assuming that net profit stays constant until 2022 is conservative.

Secondly, Dermatology’s net profit in 2016 was already SGD2.5 million and expanding the segment’s net profit to SGD3 million by 2022 should be likely given the company’s plans to recruit more doctors and its skincare product initiatives.

Lastly, the paediatrics and cancer segment is likely to grow quickly because of patient referrals and strong synergy with its core O&G business. Consider the cancer segment. The segment broke even within its first year of operations while operating profit more than doubled in 2017 compared to 2016.

Here’s another way of looking at my valuation. Growing net profit from SGD8.5 million in 2017 to SGD15 million in 2022 would imply a 12% annual growth rate. SOG was already growing net profit at 12% per year from 2012 to 2014 when it was a private company. Meanwhile, Thomson Medical, a hospital specializing in O&G and paediatrics almost doubled net profit to SGD 30 million in 2016 from SGD16 million in 2010 without major acquisitions.

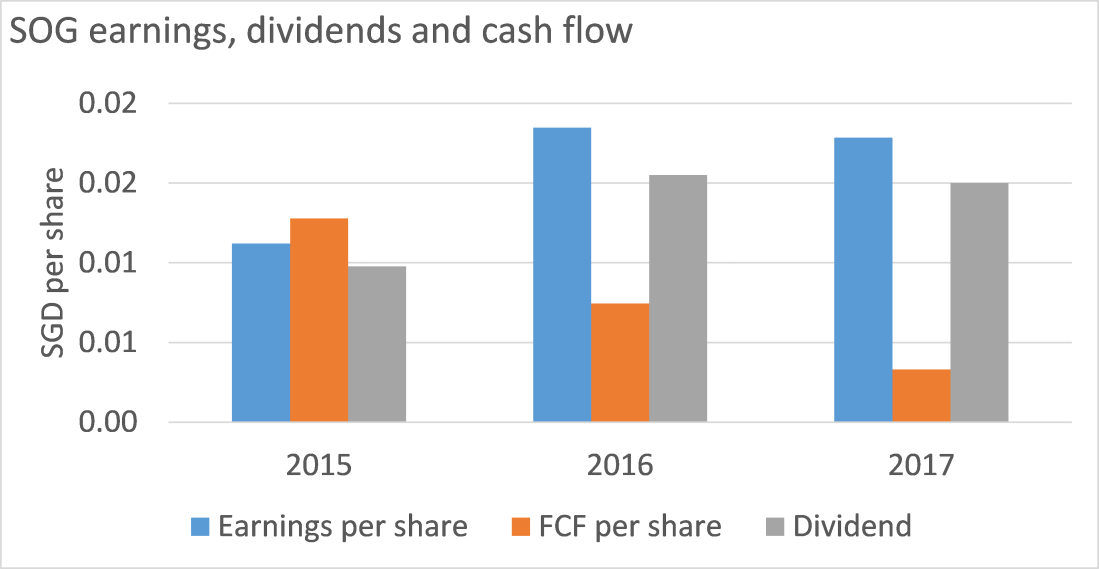

Dividends

SOG paid 1.5 cents per share in 2017 which works out to 84% of earnings per share and a 3% dividend yield. Operating cash flow in 2017 was weak but should improve in 2018 because of one-off payments related to its 2015 dermatology acquisition. Given the company’s strong cash flow and resilient earnings, the company should be able to continue paying dividends.

Key risks

SOG is vulnerable to disease outbreaks such as SARS and Zika which may discourage conception and private healthcare visitations.

SOG is overly dependent on Dr Heng with Dr Heng contributing 25% of its 2017 net profit but this is mitigated by the company’s ongoing efforts to recruit more doctors and to diversify its earnings across healthcare specialties.

Conclusion

SOG will be a healthy addition to my portfolio. Buying SOG at a SGD0.36 share price has limited downside with its solid base of recurring earnings, 3% dividend yield and free upside from growth in its dermatology, paediatrics and cancer business.

One thought on “Singapore O&G: steady growth”