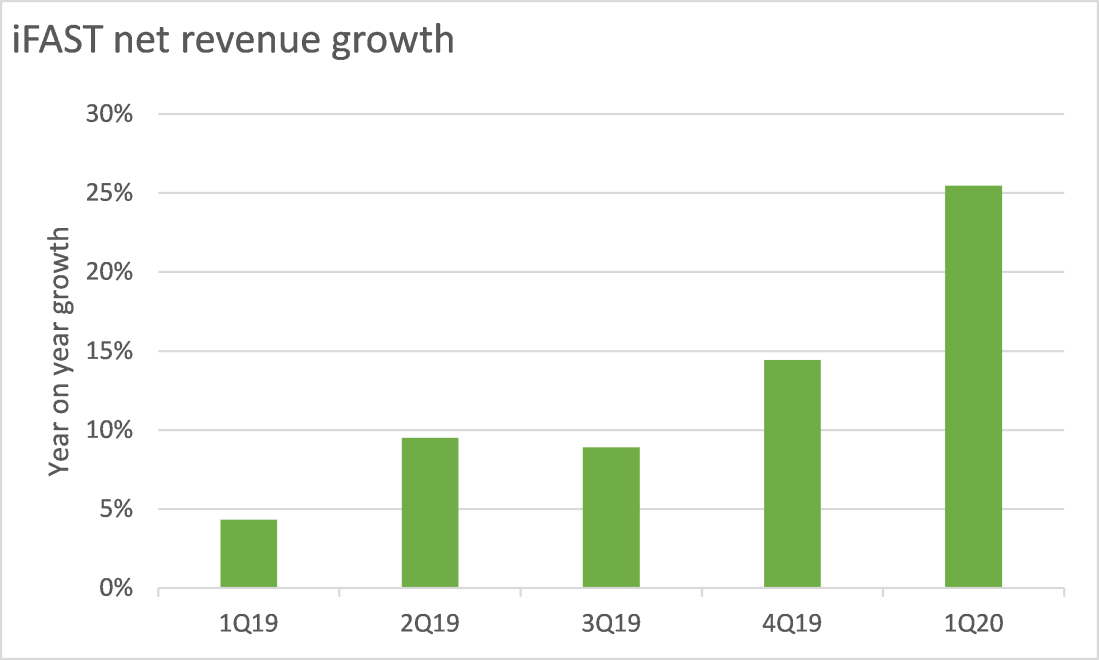

“Antifragile” refers to things which gain from disorder and iFAST had some big gains in the first quarter of 2020!

- 1Q20 net revenue grew 25% year on year(yoy) and 11% quarter on quarter(qoq)

- Recurring net revenue grew 11% yoy and 2% qoq

- Net client inflows was 224% higher year on year and 119% qoq

- Net profit grew 127% yoy and 21% qoq

- New client accounts grew 35% yoy and 10% qoq. In Singapore, there was a “record number of new account holders” during the quarter.

It may be too early to predict full year 2020 results but the improved results seem sustainable.

- Unit trust inflows jumped 148% yoy during the quarter. Unit trusts are the largest source of recurring revenue for iFAST so this is great news.

- Despite the jump in unit trust inflows, iFAST is becoming a more diversified platform and reducing dependence on unit trusts. Unit trusts made up 78% of client assets as of March 2020 compared to 92% of client assets in end-2017. iFAST clients are buying more bonds, stocks, ETFs and even using iFAST’s cash management solutions. iFAST earns a one-time fee when clients trade stocks and ETFs but recurring fees apply for bonds and cash management services. For cash management, iFAST earns net interest income and a small management fee. Cash made up 6% of client assets during the quarter which is the highest percentage of AUA since end-2017.

- Recurring net revenue for iFAST is calculated based on a percentage of average Assets under Administration (AUA) of investment products distributed on the Group’s platforms. AUA fell 4.6% year on year to SGD9.5 billion as of end-March 2020 but has recovered above the SGD10 billion mark in April 2020 because of strong inflows and a sharp bounce in share prices.

- Wealth management is a sticky business so iFAST should enjoy lasting benefits from the recent jump in inflows and new accounts. Switching costs includes time, money, uncertainty and most importantly PAPERWORK. A typical transfer form has at least 40 different fields and one needs at least two of such forms – one to transfer in and one to transfer out. It also takes 6-8 weeks to transfer out unit trusts and 2 weeks for stocks from iFAST’s FSM platform. The alternative is to sell everything and buy it again on a new platform but that could be expensive for large positions.

Last but not least, iFAST management expects year on year improvement for 2020. “Barring a substantial worsening of the global financial markets from the current levels, the Group expects the full year 2020 performance to show higher profits and revenues compared to 2019.”

In short, I don’t know if iFAST is antifragile but they are getting there with triple digit yoy and double digit qoq earnings growth during the first quarter of 2020. iFAST probably won’t grow 25% every quarter but 10-15% should be sustainable with the company being present in major wealth management hubs such as Singapore and Hong Kong. 2Q 2020 results will be another acid test so let’s wait and see.

iFAST is already one of my larger positions for my Singapore stock portfolio and I added more shares at SGD0.89.