Overseas Education Limited (OEL) is a pandemic recovery play. I bought shares after a friend told me about their big jump in school fees received in advance (“deferred revenue” for the software bros).

OEL operates the Overseas Family School (OFS) in Singapore and educates the children of expatriates working in Singapore aged 2 to 18 years old. OEL was hurt badly by the pandemic. Revenue bottomed in 2022 and the stock is an attractive and defensive long for my portfolio. Singapore is an attractive place to work and live for many expatriates. With Singapore staying largely neutral in geopolitical conflicts, and OEL deriving 100% of revenue from Singapore, OEL could also be a hedge against any political tension in the region.

This quote from the Lighthouse Advisors Fourth Quarter 2013 newsletter is one of the best introductions to date for Overseas Family School.

“Overseas Education operates the Overseas Family School (OFS) in Singapore. It caters to the children of expatriates working in Singapore. As a for-profit education business, it generates good cash flow, as little capital investment is needed beyond the initial campus construction.

For-profit schools face 2 key challenges: their fees are typically higher than those of not-for profit schools, and as relative newcomers the quality of their teaching, and thus their reputation and pricing power, is unproven.

OFS positions itself as a “premier” school and charges accordingly. This attracts only parents who are both willing and able to pay a premium. Such parents are often well educated, high-earning overachievers, who have equally ambitious goals for their offspring. Given the role that genetics plays in academic ability, highly educated parents often produce academically gifted children, who have good odds of doing well in school. The school thus starts with the best raw materials – bright pupils – in its quest for educational excellence. Students at OFS take the International Baccalaureate (IB) examinations as their final preparation for university admission. The IB curriculum is recognized worldwide, so this sidesteps the issue of the school’s reputation –results achieved by the students testify to the school’s pedagogical success. The situation that results is that the school charges a premium, thus attracting only parents whose children are already likely to do well, while their good exam results in turn allow the school to justify higher fees, some of which are reinvested into the staff and curriculum, and some of which can be returned to shareholders.

This virtuous cycle is not unlike how top universities worldwide continue their success: their reputations attract the best students, who are in turn more likely to perform well later in life, whether in academia, government service or private industry. The alma maters bask in the reflected glory – and proudly showcase their successful alumni during the next recruitment drive”

OEL has been going through a tough patch since 2015 with their revenue declining from 2015-21. Overseas Family School was previously located at Paterson Road but had to move to a new campus in Pasir Ris during 2015.

| S$m | Revenue | Net profit | Operating cash flow | Capex | Free cash flow | Net debt | Diluted shares (million) |

| 2015 | 97 | 15 | 27 | -72 | -45 | 90 | 415 |

| 2016 | 91 | 5 | 18 | -1 | 17 | 89 | 415 |

| 2017 | 87 | 6 | 25 | -1 | 24 | 83 | 415 |

| 2018 | 83 | 7 | 25 | -1 | 24 | 76 | 415 |

| 2019 | 82 | 8 | 29 | -1 | 28 | 73 | 415 |

| 2020 | 79 | 10 | 25 | -1 | 24 | 67 | 415 |

| 2021 | 75 | 6 | 18 | -1 | 16 | 63 | 415 |

| 2022 | 76 | 5 | 31 | -1 | 30 | 46 | 415 |

Why OEL revenue has been declining

Since the 2015 move, the number of students enrolling has been on a steady decline, likely due to the remote location. The pandemic also hurt student enrolments with movement restrictions limiting the arrival of expatriates in Singapore. This drop in enrolment has resulted in a sustained decline in revenue and net profit.

Despite the decline in revenue, OEL’s free cash flow remains strong with the company having minimal capex requirements after the completion of its new school in 2015. Free cash flow has averaged S$23 million over the 2016-22 period which has been more than sufficient to cover debt repayments (S$6 million per year). As a result, the company’s balance sheet has been consistently improving with net debt amounting to S$46 million as of end-2022. OEL has no share-based compensation scheme and has not issued shares since its 2013 IPO which has resulted in the number of shares outstanding being unchanged.

Revenue and student enrolment bottomed in 2022

Student enrolment and revenue bottomed in 2022 with enrolment increasing across all grades with a substantial increase in Kindergarten and Elementary school levels. OEL’s revenue increased 2% year on year in 2022 after six consecutive years of decline. School fees for OEL must be paid one month before the start of each six-months semester. School fees received in advance, an indicator of future revenue growth increased 36% year on year in 2022 and is at the highest level in 10 years.

OEL has also increased school tuition fees (starting in 1 January 2023) by an average of 6.5%. I believe higher school fees and student headcount should result in revenue growing by at least 18% in 2023.

OEL benefits from recurring revenue which is great for cash flow and earnings visibility. A school year at OFS consists of two semesters: January to June and August to December. OFS receives tuition fees for each semester thirty days before the start of each semester. Tuition fees collected for the semester starting in January are recognised equally over six months from January to June. Tuition fees for the semester starting in August are recognised equally over six months from July to December.

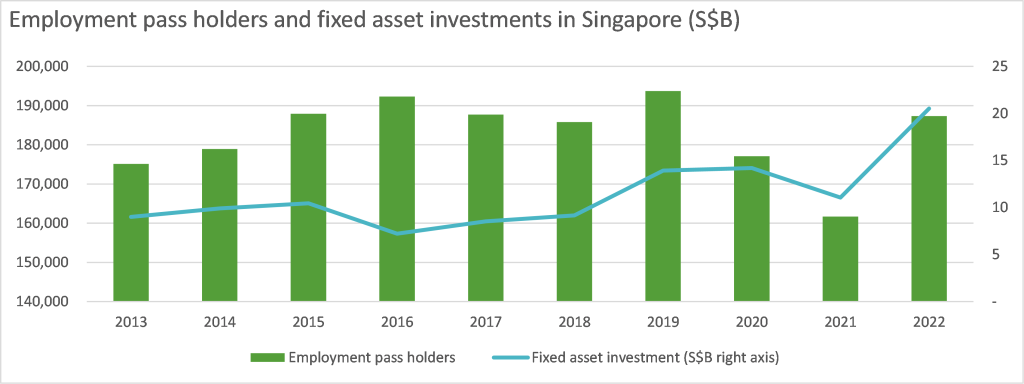

Singapore increasingly dependent on foreign workers

Singapore’s total fertility rate reached a record low in 2022. A recovery in Singapore’s low birth rate seems unlikely based on a comparison with other developed Asian economies such as South Korea and Japan.

Singapore’s low birth rates is a tailwind for international schools with the economy being increasingly dependent on foreign workers. Meanwhile, the number of employment pass holders working in Singapore increased 16% year on year in 2022 and is almost back at pre-pandemic levels.

Singapore is an attractive place to work and live for expatriates. According to the HSBC Expat Explorer 2021 report, Singapore was the most popular expatriate location in South-East Asia and the the 9th most ideal destination globally.

Singapore recently improved immigration initiatives to attract top global talent. From January 2023 onwards, foreigners earning a monthly base salary of S$30,000 or more from a single employer or those with outstanding achievements in arts, culture, sports, science, technology, academia, and research can apply for the Overseas Networks and Expertise (ONE) Pass in Singapore. Unlike Singapore’s existing employment pass permit, which is job-specific and valid for two years, ONE Pass holders can work for multiple companies simultaneously. The pass is valid for five years, and spouses of ONE Pass holders can work in Singapore after obtaining a letter of consent.

The reopening of China’s borders is also another tailwind for Singapore’s foreigner schools. Search trends on Chinese search engines suggest that the China’s reopening has resulted in a significant increase in interest among Chinese students to study abroad.

In short, there is clearly demand from foreigners to work and live in Singapore. Property prices reached a record high in 2023 forcing the Singapore government to double its tax on private property purchases by foreigners to 60%.

Fierce competition is a key threat

OFS faces intense competition with 29 schools in Singapore offering the International Baccalaureate (IB) diploma. New entrants are also a threat. In September 2023, One World International School will open its third Singapore campus in September 2023 – an IB school for 1,500 students in the upcoming Punggol Digital District (5km away from OFS).

The following table presents the location, average IB scores and school fees for schools located near OFS.

| Distance from OFS (km) | Annual fee for 7-year old student(S$) | IB Diploma | Average IB score (2022) | IB pass rate (2022) | Student capacity | |

| Overseas Family School | – | 33,650 | Yes | 37.0 | 97.9% | 4,800 |

| United World College East | 4 | 40,140 | Yes | 38.0 | 98.1% | 2,806 |

| Global Indian International | 5 | 24,603 | Yes | 38.6 | N/A | 3,500 |

| Middleton International | 10 | 17,587 | No | N/A | N/A | 1,000 |

| Nexus International | 12 | 39,000 | Yes | 36.0 | 100.0% | 2,000 |

| Canadian International | 20 | 35,400 | Yes | 37.0 | 99.2% | 2,050 |

IB schools generally charge higher school fees because of accreditation requirements. Middleton International is thus able to offer a more affordable alternative by offering British and international curriculum alternatives to IB. Meanwhile, Nexus International School moved to its new campus in 2020 which is located 15 kilometres away from OFS.

Let’s take a closer look at United World College East (UWC East) since it is the largest and nearest competitor to OFS. UWC East is part of an international network of 18 schools across four continents and was founded in 1962. UWC East is the second UWC campus in Singapore and started operations in 2008. The UWC East campus is located 4 kilometres away from OFS. UWC East positions itself as a premium school and charges higher school fees and registration fees compared to OFS and other nearby schools. The non-refundable enrolment/registration fee for UWC is ~$$5,500 compared to S$2,000 for OFS.

OFS stands out against its peers because of 30 years track record in Singapore and its unique admission policy. OFS has an open entry policy by enrolling foreign students of all abilities, without entry tests. Despite this policy, OFS has consistently ranked among the top 15 international schools in Singapore in terms of the average IB results.

The open entry policy of OFS appears to be a counter-positioning strategy which has worked well since the school’s inception in 1991. Top schools are hesitant to adopt it to avoid harming their academic track record. OFS thus attracts a broader audience, offering a unique approach that values inclusivity and diversity.

This OFS LinkedIn post details the school’s open entry policy:

“From the beginning, OFS stood out. It did not seek to replicate the status quo. We wanted our students to be happy, respectful of all our nationalities and cultures and guided them towards self-discipline. We were clear from the start that we should not label children at an early age, pigeon-holing them into a pre-set future, as in generations past. The obvious example, both then and now, is that in our school, every student can take the full IB Diploma and choose any subject they wish, even at Higher Level. There are no restrictions and for that reason we may never have a 100% IB Diploma pass rate”

Switching schools can incur high switching costs, including the potential loss of established social connections, adjustment to a new environment, and potential differences in academic curriculum or teaching methods. Once children have made friends and established routines, parents may also be reluctant to disrupt their social and academic progress by moving them to another school.

Overall, I think the company’s brand, counter-positioning strategy and switching costs amounts to a narrow moat so intense competition will always be a risk for OFS. I’m relying on OFS to stay innovative and relevant against their peers. With so many international schools competing for students, my guess is that this space will see consolidation and acquisitions over the next few years.

Management and incentives

Management has decades of experience and skin in the game. CEO and co-founder Irene Wong Lok Hiong, currently 68 years old owns ~32% of the company as of March 2023 and has more than 40 years of experience in managing foreign system schools. Despite owning a substantial stake in the company, the CEO takes a low fixed salary (S$384,000 in 2022) with no bonus so she has an incentive to improve dividends. The company has a policy of paying out at least 50% of net profit every year.

Succession planning appears to be underway because Ms. Joyce Chee, the daughter of Ms. Irene Wong sits on the executive board of the school and was promoted to Admissions Director in 2022. She joined OFC as a management trainee in 2009.

Mr. David Perry, currently 81 years old was the other co-founder of OEL and owns ~31% of OEL as of March 2023. In 2022, Mr. Perry stepped down as CEO and director of the company due to health reasons.

Separation of management and academic roles enables specialization. Teaching is organised into four age-related schools, each with a Principal and academic support team. Academic teams are allocated a bare minimum of administration, so they can focus on students.

There are only 21 employee reviews of OFS on Glassdoor reviews with the company scoring 3.5 out of 5 stars so take these reviews with a pinch of salt. OFS employee reviews generally seem positive with most teachers appreciating the high salary and employee/student diversity. Negative reviews generally revolve around the school’s remote location and low salary adjustments.

Valuation and key risks

Based on the company’s S$0.24 share price, OEL has a trailing 4.5% dividend yield and is trading at ~19x trailing PE and ~6x EV/EBITDA . These metrics seems cheap for a company about to experience a post-pandemic recovery. Canadian International School, a competitor to OEL was acquired at 14x EV/EBITDA in 2020.

I expect OEL’s share price and dividends to grow in line with earnings over the next 12 months. Revenue and earnings per share in 2023 is expected to grow 18% and 60% respectively because of improved student enrolment, higher tuition fees and operating leverage. Apart from personnel expenses, the company’s other expenses are mostly fixed costs such as depreciation and maintenance costs.

I have not predicted financial results beyond 2023 because it’s a pointless exercise if the company is unable to profitably grow student headcount and revenue.

Increasing student enrolment beyond current levels seems to be a condition for OEL to renew the land lease for the school after the current lease ends in 2043 based on OEL’s auditor comments in the 2022 annual report.

“We reviewed Management reports and supporting documents assessing the conditions of renewal, taking into consideration the overall private education landscape and external information. As part of assessing the conditions imposed by the relevant authorities, we compared the Group’s fee structure against other competitors in the international school market and Management’s assessment of the Group’s ability to increase its student headcount.”

I have already mentioned how intense competition is a key risk for OEL. OEL could also be hurt by an economic downturn which could result in a decline in the number of expatriates working in Singapore.

Final words

In short, growing student headcount while maintaining profitability will be a key metric to decide if OEL is a cheap stock or a value trap. If student headcount and revenue decreases for two consecutive years, I will have to re-evaluate my investment. What do you think? Is OEL a value trap or a turnaround play?