Disclosure: I am a iFAST shareholder! The fourth quarter of 2023 was all about iFAST’s ePension segment with contributions from the unit’s Hong Kong eMPF contract leading to net profit growing 917% year on year.

eMPF

eMPF will be the biggest source of revenue for iFAST over the next 2 years. iFAST lowered revenue guidance for 2024-25 because of “timing delays”. However, profit targets remain unchanged because the slower ramp-up of the project will also result in lower expenses. I’m a bit disappointed but long delays are common for big IT projects. iFAST has been conservative about Hong Kong profit targets with the company already exceeding 2023 targest. Expect another spike in earnings growth during second quarter of 2024. According to this article, the first MPF trustee will begin onboarding assets during the second quarter.

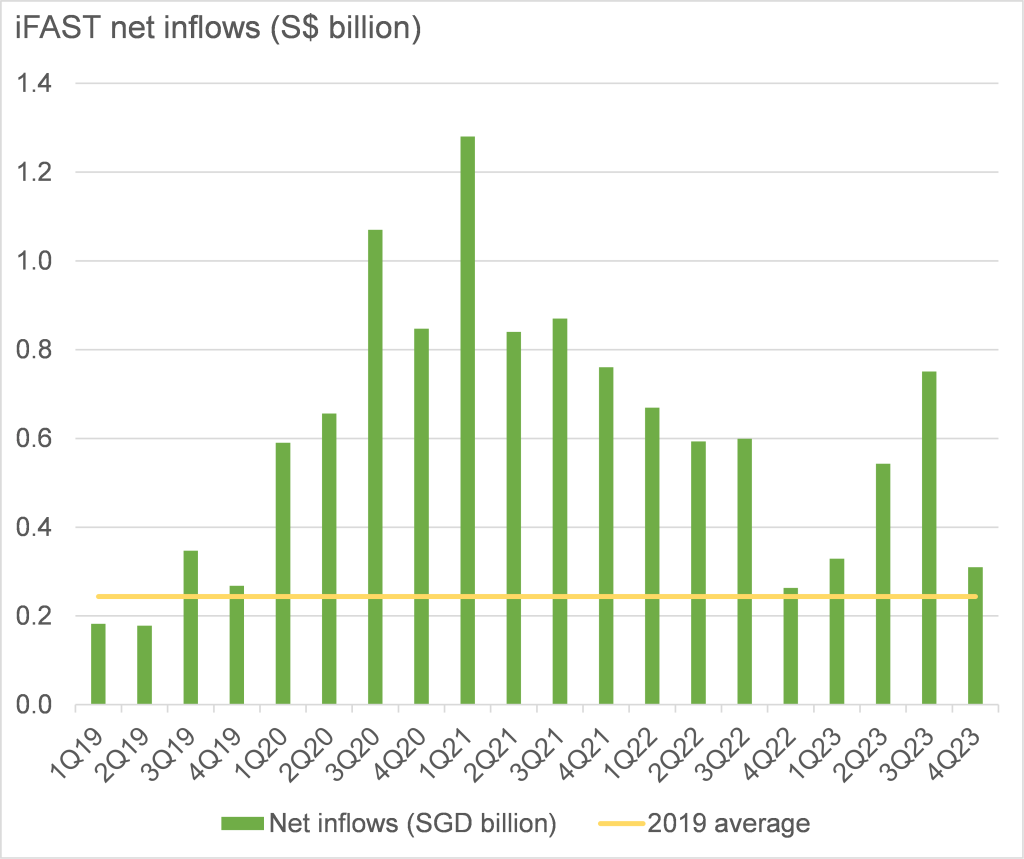

Net inflows

4Q23 net inflows were higher year on year and 2019 levels but fell 58% quarter on quarter. One of their B2B customers withdrew equities. Most B2B customers of iFAST are financial advisors rather than stockbrokers so such withdrawals will hopefully be a rare occurrence!

iFAST Global Bank (IGB)

IGB, the company UK digital bank reported a $2.6 million pretax loss in the fourth quarter of 2023 compared to $2.1 million in the third quarter of 2023. iFAST is guiding for losses to narrow in 2024 and for the bank to breakeven in the fourth quarter of 2024. IGB has a simple and low-risk business model with the bank mainly offering customers an attractive 4.25% on their GBP deposits while these deposits are kept at the Bank of England resulting in a 1% net interest margin. This conservative model avoids duration mismatch. The cash is always there if the customer needs it!

IGB reported a $8.6 million pretax loss for 2023 and based on their existing 1% net interest margin, I estimate that the company will need another $900 million of new deposits to breakeven. Deposits have been growing nicely but growth will have to accelerate over the next few quarters. I’ll be a lot more comfortable if deposits are growing by about $200 million per quarter. IGB seems to be doing well with UK residents accounting for about 30% of the deposits, while the rest comes from residents of over 60 countries from around the world. New payment features will hopefully attract more personal banking deposits. IGB recently implemented Faster Payments to allow for immediate electronic transfers locally and is planning to launch a multicurrency debit card in 2024.

As I explained previously, IGB is a game-changer for iFAST because net interest income will be a strong source of counter-cyclical source of income compared to volatile revenue from unit trusts and stocks. iFAST can also cross-sell unit trusts, stocks, and bonds to their banking customers.

Other bets

Improving the company’s core wealth management platform is also a key focus. iFAST recently secured a license in Malaysia to establish a bond exchange for retail investors. The bond exchange will be located in Malaysia but will benefit iFAST customers globally. iFAST is aiming to launch this bond exchange during the second half of 2024.

IFAST currently sells bonds through its Bond Express services but this process is manual, slow and based on a request for quotes. Unlike stocks, bond trades cannot be transacted and confirmed instantly on iFAST platform but having a bond exchange will improve price transparency and execution speed.

In Singapore, iFAST has also offered customers a debit card which allows them to spend their investment proceeds and dividends directly. With iFAST enjoying increased profitability, the company has offered cashback promotions to encourage debit card spend on food and groceries during February 2024. A debt card should encourage customers to deposit more cash in iFAST cash management account and increase the stickiness of the company’s platform.

iFAST Singapore has also offered margin financing for wealthy investors to encourage larger trades on the platform.

All of these services makes iFAST platform stronger and sticky. Better, cheaper and faster bond trades, margin financing along with debit card services attract new customers while increasing switching costs.

Summary

There’s a lot to like about this quarter. Pretax profits are at a record high and iFAST is steadily improving their platform. However, the stock isn’t cheap and is pricing in good execution for the eMPF contract. Even with the recent spike in earnings, iFAST is still trading at 82x trailing earnings. What do you think about this quarter?

too expensive valuation!!!

LikeLike