iFAST has published their 2018 annual report with the company reporting the highest growth in client accounts since it was listed.

These statistics were previously released in their February 2019 results presentation but they jumped out at me when I was reading their annual report.

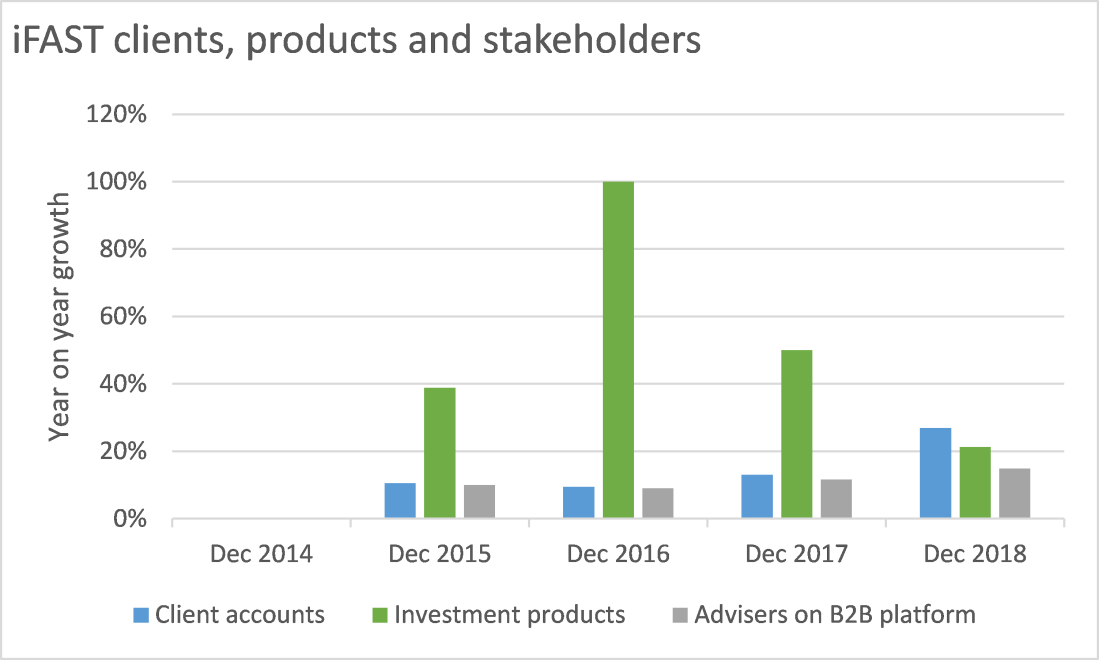

As of end 2018, the number of client accounts grew 27% year on year to 330,000 which marks the highest growth for the company since it was listed in 2014.

The company’s B2B platform also showed healthy growth with the number of advisers using the platform growing 15% year on year.

As I mentioned in my earlier post, iFAST benefits from network effects so a bigger client base is likely to attract even more product providers and advisers onto their platform.

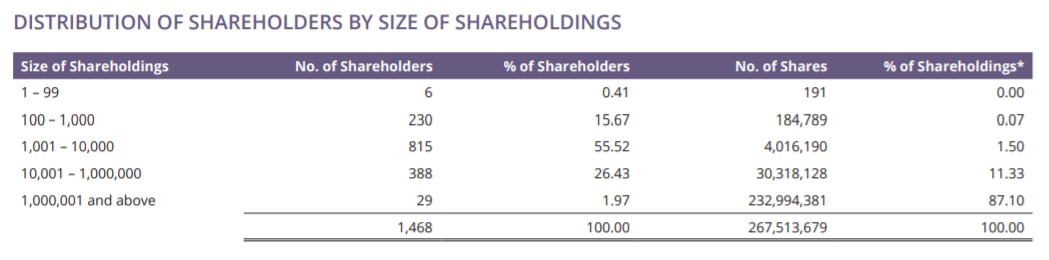

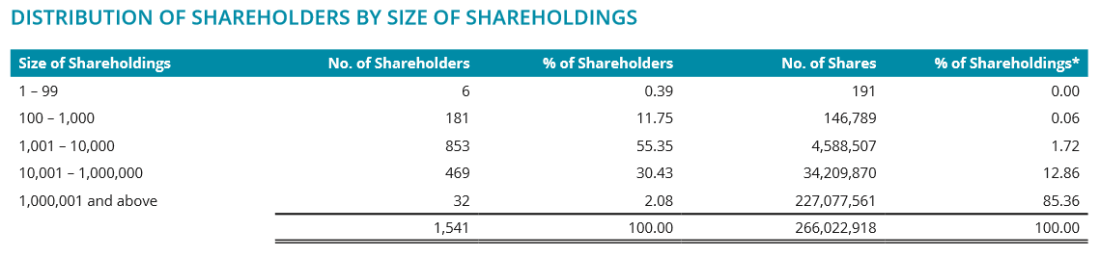

Lastly, it seems retail shareholders are becoming pessimistic on iFAST. The number of shareholders as of March 2019 has fallen 5% year on year to 1,468. This drop in the number of major shareholders (owning 10,001 -1,000,000 shares) was especially striking with 388 shareholders compared to 469 in March 2018. This trend suggests that retail shareholders are losing patience in iFAST and the share price is undervalued.

iFAST shareholders as of 9 March 2019

iFAST shareholders as of 7 March 2018

I’m planning to attend the AGM on 16 April and will update if there are any interesting insights.