HRNet and Singapore O&G are the most profitable companies in my portfolio based on the gross profitability ratio.

After reading Michael Mauboussin’s excellent Base Rate Book, I applied the gross profitability screen to my existing portfolio. Gross profitability or Gross Profits divided by Total Assets measures a company’s ability to make money and is used as a measure of quality. Professor Robert Novy-Marx found that the share price of the most profitable non-financial companies tended to outperform the least profitable companies.

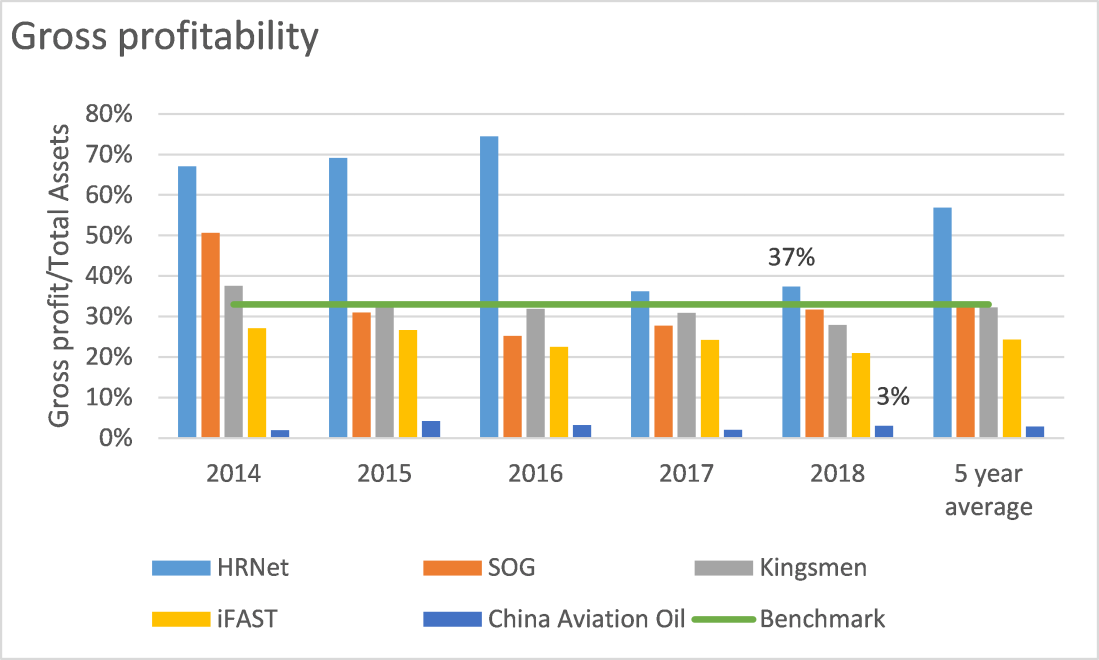

According to Novy-Marx, a 33% gross profitability ratio is generally regarded as attractive. Lastly, companies with high gross profitability tend to maintain their profit margins in the future so this ratio seems to be a good predictor of future returns.

HRNet had the highest gross profitability while China Aviation Oil had the lowest gross profitability in 2018.

In the last five years, the gross profitability of HRNet, SOG and Kingsmen have been above 33% so that speaks well of their ability to generate asset-light returns.

HRNet gross profitability fell in 2017 because of the company’s IPO but is the most profitable in my portfolio. Funds raised will be used for its North Asia expansion plans and given the company’s solid M&A track record, HRNet should continue to do well.

Singapore O&G (SOG) gross profitability fell in 2015 after its IPO but has been steadily improving with its younger specialists performing well.

Kingsmen gross profitability fell in 2018 probably because of the company’s purchase of its new Changi Business Park headquarters and start-up costs related to NERF. It’s still early days for Kingsmen and I’m excited to see how their Marina Square NERF attraction will perform in 2020.

iFAST gross profitability has been falling because of the company’s expansion into the competitive China investment platform market but these efforts should be fruitful based on the company’s past track record in Singapore, Hong Kong and Malaysia. Investment platforms usually incur substantial losses in the early years because of their fixed costs but profits will expand quickly once the platform accumulates enough assets.

China Aviation Oil’s ratio looks low because it is partly a “financial company” because contributions from its Pudong airport associate have been excluded while its jet fuel trading activities requires substantial inventory. China Aviation Oil has a long runway with only 10% of the Chinese population having a passport so I’m happy to hold on my shares.

This gross profitability screen has confirmed that my portfolio is of decent quality and I’m excited to see how they will perform for Q1 results in April!