Singapore O&G (SOG) is a healthcare company focusing on specialist practices such as obstetrics, dermatology, gynae-oncology, and paediatrics. SOG was incorporated in 2011 and listed on the SGX in 2015 with 7 doctors. Since its IPO, SOG has grown headcount mainly through doctor recruitment rather than acquisitions. The company’s only acquisition to date involved the acquisition of Dr Joyce Lim’s dermatology practice in end-2015.

| SOG financials | 2017 | 2018 | 2019 | 2020 | 2021 |

| Revenue | 29.9 | 34.7 | 38.8 | 40.4 | 41.8 |

| Net profit | 8.5 | 9.1 | 10.4 | 11.4 | 13.6 |

| Recurring net profit | 8.5 | 10.8 | 10.4 | 11.4 | 13.6 |

| Recurring net profit growth | -3% | 27% | -4% | 10% | 19% |

| Trailing P/E | 21.0 | 16.6 | 17.2 | 15.7 | 13.2 |

| Trailing EV/EBITDA | 15.5 | 11.3 | 12.3 | 11.2 | 9.4 |

As of August 2018, SOG employs 16 specialist doctors which includes seven O&G specialists, three cancer specialists, two dermatologists and four paediatricians. The O&G segment is the largest contributor making up 60% of revenue but SOG is aiming for equal revenue contributions from each segment.

The paediatric, dermatology and cancer doctors have strong synergies from O&G referrals and continue caring for patients as they age making their services more sticky. Patients benefit from a consistent standard of care and the company’s team-based approach for complex conditions so they are less likely to switch to other healthcare providers.

Paediatrics allows SOG to accompany patients from birth, dermatology helps pregnant patients and their children with their skin issues while gynae-oncology is crucial as breast cancer is the most common form of cancer in Singapore.

Huge upside for 11 out of the 16 existing SOG doctors

There is huge upside from younger SOG doctors as their 2018 earnings are well below their older peers. These younger doctors are already improving their surgery/patient loads because of inter-clinic referrals.

Paediatric segment started 2 years ago and only broke even in 1H 2019. Based on industry averages, each SOG paediatric doctor can eventually contribute up to SGD 1 million in net profit as they grow their patient load.

SOG doctors delivered more than 1,800 babies in 2018 so expanding into paediatrics is a natural fit. Paediatrics allows SOG to stay connected to younger patients, especially female patients. Like obstetrics, this business is less vulnerable to low cost foreign competition.

SOG’s paediatric clinics are typically located in the same hospital as other SOG obstetricians to provide seamless healthcare. For example, Dr Lim’s paediatric clinic is located in the same hospital as two of its key O&G doctors: Dr Heng Tung Lan and Dr Natalie Chua. Dr Heng and Dr Natalie Chua deliver a combined total of almost 1,000 babies annually which will be a strong referral pipeline for the clinic. SOG has also recruited two paediatric doctors with a unique expertise in 2018. Dr Christina Ong specializes in managing children with gastrointestinal conditions while Dr Petrina Wong is focused on childhood respiratory and sleep conditions.

With new clinics typically requiring 1-3 years to be profitable, SOG’s paediatric segment broke even in 1H2019 and should grow quickly with 4 doctors in this segment.

Cancer is the leading cause of death in Singapore according to Singapore’s Ministry of Health while breast cancer is the most common form of cancer among women in Singapore. SOG’s cancer segment is focused on female-related cancer cases such as breast cancer and this segment is well positioned to deal with the growing number of cancer cases in Singapore and Singapore’s ageing population.

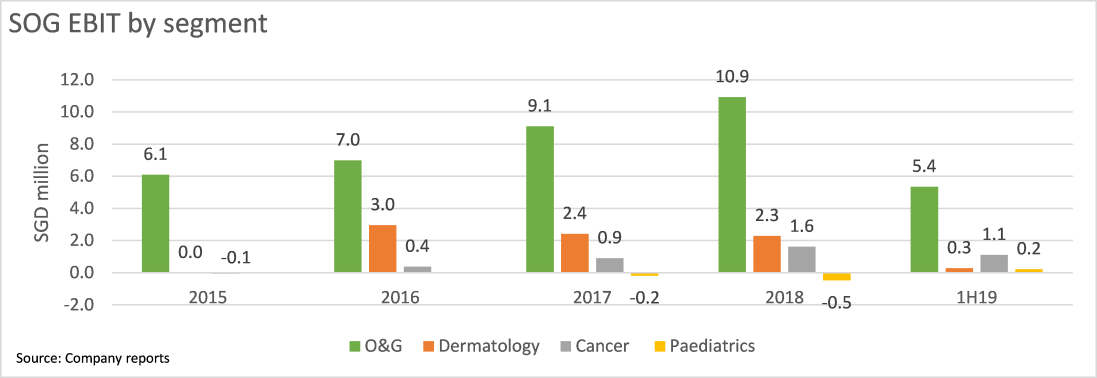

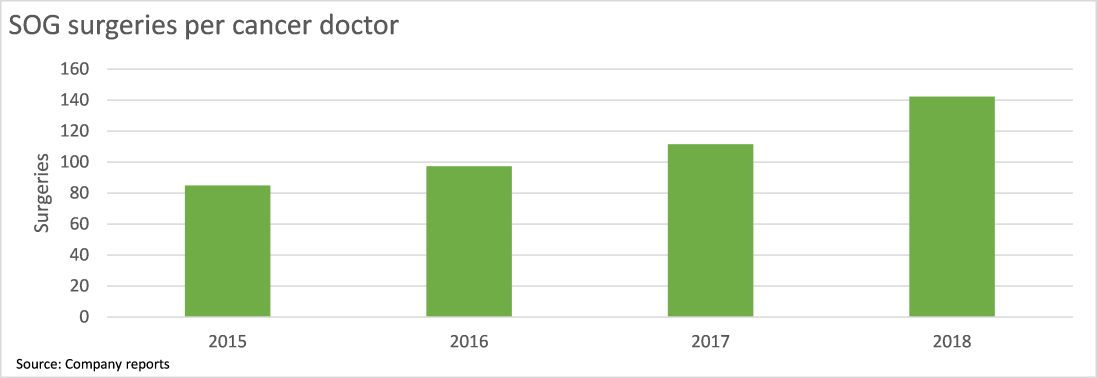

SOG established its cancer segment in 2015 by recruiting two cancer surgeons and this segment broke even within 12 months. EBIT contributions have grown 4x since the segment broke even in 2016 and this segment is already SOG’s second largest segment by EBIT as of the first half of 2019.

SOG’s cancer segment has been growing quickly with the average number of surgeries per doctor growing 67% over the 2015-18 period but there is still room to grow with each SOG cancer surgeon doing 142 surgeries (~1 surgery every other day) on average in 2018.

Lastly, SOG patients who have skin problems due to pregnancy or going through hormonal changes can consult the company’s dermatologists. SOG established its dermatology business by acquiring Dr Joyce Lim’s dermatology practice in end-2015 for SGD26.5m (11x trailing P/E). Under the direction of Dr Joyce, SOG can assemble a team of dermatologists to treat patients referred from the company’s O&G and paediatric clinics.

The dermatology segment which is led by Dr Joyce Lim has been affected by falling medical tourist arrivals with earnings falling over the last two years. SOG wrote down SGD2.8 million of goodwill for the dermatology segment in 2018. To improve earnings at its dermatology segment, SOG has recruited Dr Liew, a dermatologist with sub-specialty in children skincare issues. Given Dr Liew’s strong focus on women and children skincare issues, her practice should enjoy synergies with the company’s O&G segment. Dr Joyce Lim also has a strong incentive to improve dermatology earnings as she owns 8.5% of SOG shares which are collectively worth SGD15 million. Dr Joyce is developing a line of skincare products (eg. stretch mark cream) for SOG’s pregnant patients.

Resilient growth across all economic conditions is a strength with SOG focusing on crucial specialties.

SOG concentrates on crucial specialties such as obstetrics (O&G), gynae-oncology, and paediatrics. These segments are less vulnerable to recessions and medical tourism trends resulting in 27% recurring net profit growth from 2015-18. Net profit in 1H 2019 fell 9% year on year because of start-up losses from hiring new doctors but overall earnings should improve from 2020 onwards. With SOG hiring 4 doctors in the last 18 months and the paediatric segment breaking even in 2019, earnings per share CAGR should be at least 10% in 2018-23 even if SOG stops hiring doctors.

Although Singapore’s birth rate is falling, there are three reasons to believe that SOG can continue growing. Firstly, SOG has been steadily growing market share in the number of baby deliveries.

Despite growing market share for seven consecutive years, SOG’s market share for Singapore’s private births was 8.9% in 2018 so there is still room to grow. Growth during the 2016-17 period was especially impressive as SOG did not recruit additional O&G doctors which suggests that the company’s doctors are delivering more babies and gaining recognition.

Secondly, babies born in private hospitals only make up only 52% of all baby deliveries in 2018 so there is still ample runway for growth.

Lastly, Singapore’s birth rate is already one of the lowest in the world and the government has been introducing incentives to improve the birth rate which includes longer periods of paid maternity leave, paid paternity leave and subsidies for assisted reproduction.

Valuation

At a SGD0.38 share price, SOG is trading at a 17x trailing P/E if we exclude goodwill impairments and its valuation is at the lower end of its trading range since its June 2015 IPO. This seems to be a fair price for a healthcare company given its predictable earnings and steady growth potential.

SOG’s valuation is also supported by the company’s dividend so investors are paid to wait for the market to re-rate the company. The company has paid out a dividend every year since its 2015 IPO and the company’s 2018 (SGD0.017/share) dividend is well covered as it makes up 75% of recurring earnings and 60% of free cash flow.

SOG is worth at least SGD0.67 per share (79% upside) even with conservative assumptions.

The following assumptions were used for our valuation:

- Doctor headcount stays constant.

- O&G EBIT remains flat at 2018 levels (SGD11 million) even after a new doctor was hired in 2019 to allow for reduced patient load from the founding O&G doctors.

- Dermatology EBIT stays flat at 2018 levels (SGD2.3 million) in 2023 even after a new doctor was hired in 2018.

- Cancer segment grows to SGD5.9 million EBIT in 2023 which implies SGD1.6 million net profit per doctor which is comparable with established oncology surgeons (Talkmed 2018 net profit/doctor is SGD1.9 million).

- Paediatric segment grows to SGD3.6 million EBIT in 2023 which implies SGD0.8 million net profit per doctor.

- 7% cost of capital and 2% terminal growth rate

Key risks

SOG is dependent on 3 O&G doctors with these doctors contributing ~42% of 2018 recurring net profit but they have skin in the game as they are the largest SOG shareholders. SOG is well aware of key man risk issues and has been recruiting more doctors to diversify its earnings across healthcare specialties.

Write-downs for the dermatology segment’s remaining goodwill (SGD23 million) will hurt earnings and share price sentiment. But as mentioned earlier, this is likely to be a short term issue and dermatology should improve in 2020.

In short, buying SOG at a share price of SGD0.38 (as of 8 August 2019) could yield 79% upside with its solid base of recurring earnings, 4.1% trailing dividend yield and upside from growth in its paediatrics and cancer business. Dermatology should improve in 2020 with SOG recruiting a new dermatologist specializing in children skincare.